When is a car considered a total loss? Learn how it is calculated and what constitutes technical and economic total losses.

Total Loss on a Vehicle – What Does That Mean and How is it Calculated?

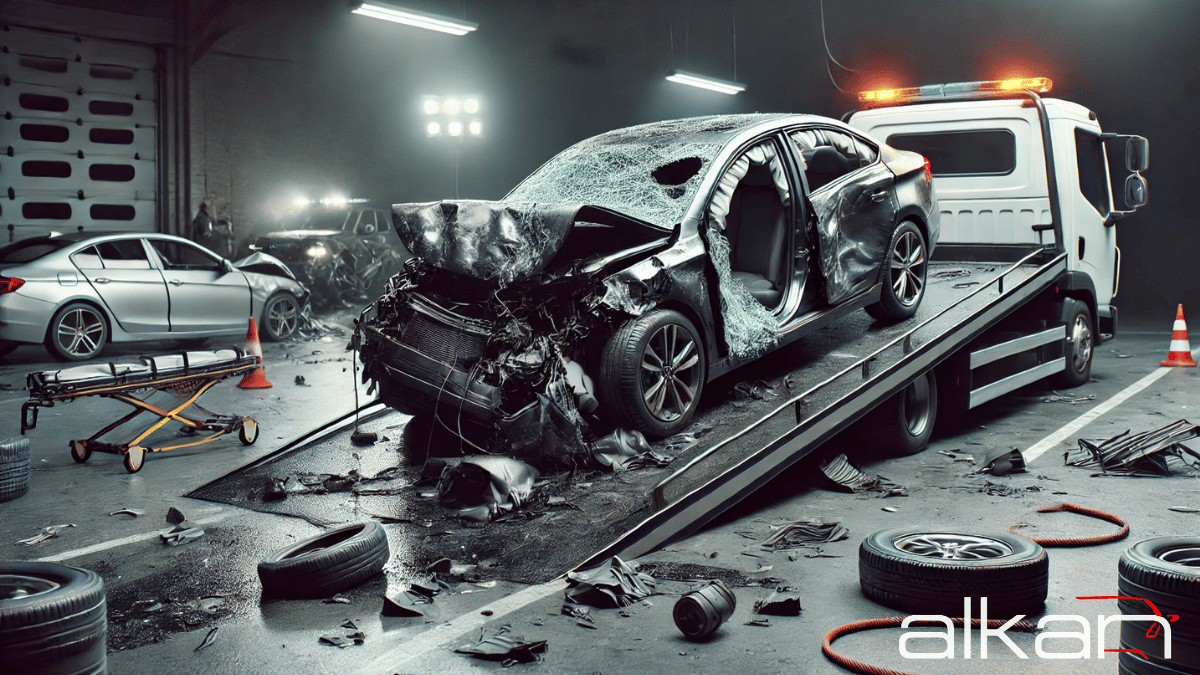

Total loss is the worst-case scenario for many drivers after an accident, and the term is often confusing. But when exactly is a vehicle considered a total loss, and how is the damage calculated? In this article, we explain simply and clearly what a total loss is, the types of total losses, and how the calculation works.

What is a Total Loss?

A total loss occurs when a vehicle is economically irreparable or technically irreparable.

Technical Total Loss:

In this case, the vehicle is so severely damaged that a repair is technically not possible. Typical examples are a destroyed frame or significant damage to structural components.

Economic Total Loss:

A repair is technically possible, but the repair costs exceed the vehicle's value before the accident. In these cases, it no longer makes sense financially to repair the car. Usually, when repair costs exceed around 70–80% of the replacement value, an economic total loss is declared.

How is a Total Loss Calculated?

The calculation of a total loss is based on three main components:

📌 Replacement Value

This is the amount that a similar vehicle was worth before the accident – the market value of the car. For example, if the vehicle was worth 10,000 €, this value is used for calculations.

📌 Repair Costs

The estimated costs to properly repair all identified damages.

📌 Salvage Value

The value of the damaged vehicle after the accident. This is determined in the appraisal – e.g., scrap value or market value for still usable parts.

Calculation Formula:

If the repair costs exceed the replacement value, an economic total loss occurs. It is usually calculated like this:

Insurance Payout = Replacement Value – Salvage Value

Example:

A car has a replacement value of 10,000 € and a salvage value of 3,000 €. The repair costs 9,000 €. In this case, the repair costs do not exceed the vehicle’s value before the accident, so a repair might still make sense economically. However, if this amount exceeds the replacement value, it is considered a total loss.

Special Case: 130 Percent Rule

In some cases, the so-called 130 percent rule still allows repairs:

If repair costs are up to 130% of the replacement value and the vehicle is used for at least six more months, the insurance can cover the costs up to this amount – even if an economic total loss technically applies.

New Vehicles and Special Cases

For very new vehicles (e.g., only a few weeks old or low mileage), new value compensation may apply, where the full purchase price is reimbursed – for example, by the liability of the accident-causing party or, depending on the insurance policy, by comprehensive insurance.

What Happens After a Total Loss is Determined?

• In the case of a technical total loss, the vehicle is generally irreparable and is scrapped. The salvage value is usually zero.

• In the case of an economic total loss, the difference between the replacement value and the salvage value is paid out.

Conclusion

A total loss doesn’t always automatically mean the car is “broken” – instead, it’s based on an economic assessment of whether a repair is worthwhile. The calculation is made by comparing repair costs, replacement value, and salvage value. A qualified car appraiser determines these values and provides an objective basis for decision-making.